Stealth mode startups have become a regular occurrence in the high-growth ecosystem but, as their name suggests, they’re secretive in nature and thus not widely known. Plenty of early-stage businesses also raise funding in stealth mode—around 70% of UK equity deals aren’t announced to the public, while more than three-quarters of fundraisings under £500k go unannounced.

What is a stealth mode startup?

Typically, a stealth mode startup aims to hide everything it’s doing from the public. Common disguises include: operating under a secret name, assigning code names to new products, running a basic website that keeps a company’s employees and location a secret, or operating a strict PR policy and requiring employees to sign non-disclosure agreements (NDAs).

Meet 5 Tech startups that recently exited stealth mode, revealing a funding round:

Manigo

📍 LONDON

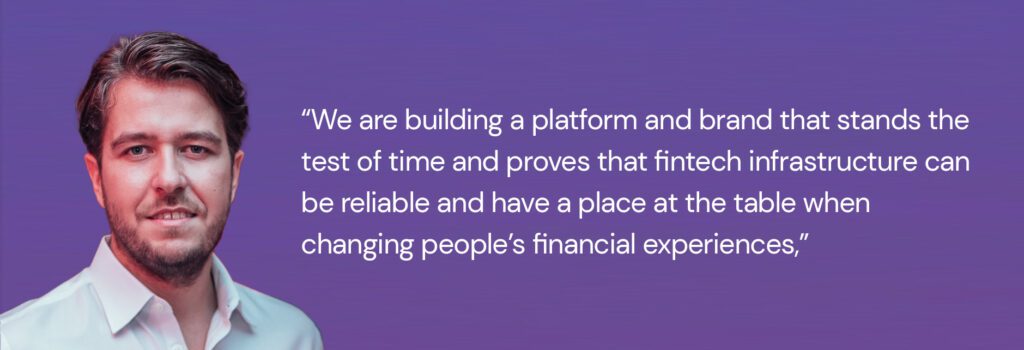

Manigo, a London-based fintech infrastructure company offering a ‘low code’ way to other firms to launch cards, accounts and payments services under their own brand, has launched. Founded by Stevan Bajic and Olya Parafiyanovich in 2016, It also provides a core banking and infrastructure platform.

The company recently raised $5.3m to date from several unnamed global strategic investors.

“It’s a huge relief to finally be talking about Manigo after quietly building a robust and fully-rounded platform for the past few years,” said Stevan Bajic, CEO and co-founder of Manigo.

Manigo is launching its fintech infrastructure platform in the UK, Europe and the Americas and has been testing with clients across Europe and the UK.

👀 Follow them to watch this space

Newsmatics

📍 London & US

Newsmatics is seeking to innovate on the newswire model by providing a less expensive product that doesn’t require support or input from a communications professional. The platform would allow businesses of all sizes to create, publish and distribute their news, according to EZ Newswire.

The company is using artificial intelligence technology to produce announcements on behalf of clients. Users must answer a few questions for the tool to create a story based on the information provided.

The platform has a network of publisher contracts, including an integration with the Associated Press, and it plans to expand that network and release more features after the launch, according to EZ Newswire.

👀 Follow them to watch this space

Aspect

📍LONDON

Aspect, a direct and facultative (D&F) startup, has exited stealth mode to focus on writing hard to place small to mid-market property (re)insurance across the UK and Europe.

Aspect said it hopes to help brokers deliver for their clients by writing underserved segments of the (re)insurance market and by utilising the latest tech platforms to gain advantages in speed and risk insight.

Aspect will initially begin in the direct and facultative small to mid-market property arena in the UK, Ireland, Netherlands, and more widely across the whole of continental Europe, with plans to expand beyond this in the future.

The company, which is reportedly backed by Everest Re and AmTrust, has so far written around £5.5m of gross premiums while in stealth mode and expects premiums to top £25m annually by the end of next year.

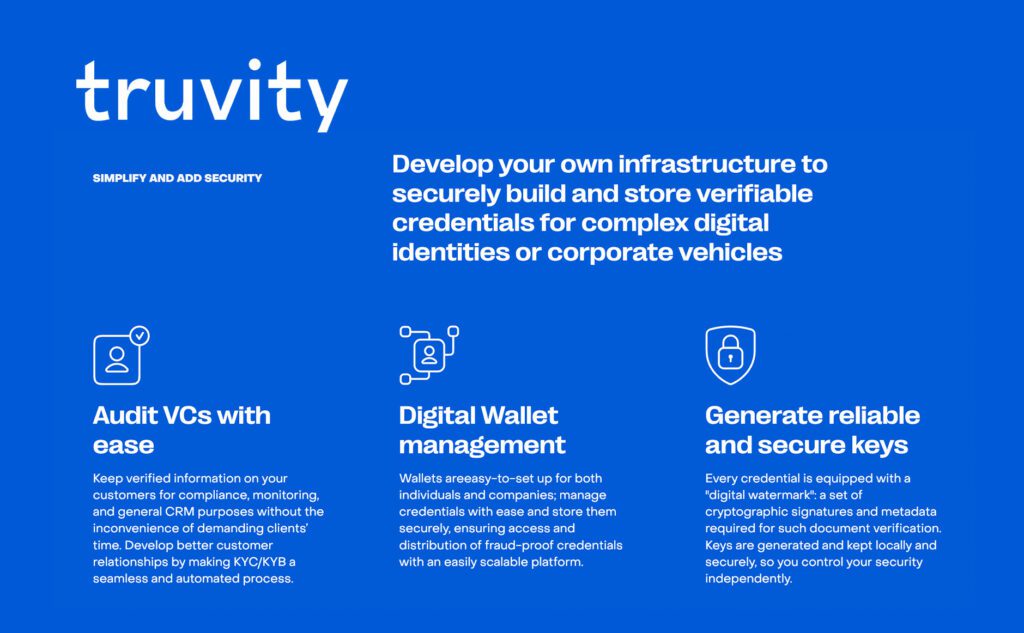

Truvity

📍 Amsterdam

Amsterdam-based Truvity, a Self-Sovereign Identity (SSI) platform, announced on recently that it has exited stealth and launched its first product — a platform with SDK and API that will facilitate the development of applications that utilise SSI (Self-Sovereign Identity) technologies.

The company also disclosed that it secured €8M in funding from Artek Group PLC. It is now rolling out early access to its technology. Artek Group is a business incubation platform and services provider that supports fast-growing and forward-thinking companies across sectors and geographies. The company invests in innovative early-stage startups and established firms in financial services, financial and regulatory technology, SSI, and other industries.

Truvity’s CEO and co-founder, Konstantin Mashukov, says, “We encourage ambitious innovators, pioneering companies, curious researchers, and SSI enthusiasts to try our platform.”

“Start building applications with Instant Trust under the hood powered by SSI technologies, bringing advantages for businesses, governments, and citizens. Initial access will be free for early adopters, and we are ready to provide all the necessary support,” adds Mashukov.

Founded by Konstantin Mashukov and Denis Nagy, Truvity’s Self-Sovereign Identity toolkit allows users to build their digital identity ecosystem. This toolkit includes features such as instant identification and verification, operating on Self-Sovereign Identity principles.

👀 Follow them to watch this space

M^ZERO

📍BERLIN

Berlin-founded, next-generation DeFi Platform M^ZERO exited stealth mode in May this year after raising a $22.5M funding round. The seed capital was led by Pantera Capital and included the Scaramucci-linked SALT Fund, and Mouro Capital, the venture capital operation connected to the Santander Group.

M^ZERO, a decentralized infrastructure layer for digital asset value transfer, has emerged from stealth mode with the intention of advancing the pioneering work done in decentralised finance (DeFi).

The M^ZERO platform, helmed by players with backgrounds in both traditional finance and decentralized communities such as MakerDAO, will be taking an institutional-grade approach to DeFi.

“We are researching the development of a decentralized protocol, but the decentralized governance that we have in mind will be significantly different from the model based on airdrops, open Discord channels or forums, and anonymous participation,” he said. “You could think about it as a consortium of sophisticated parties rather than a [decentralized autonomous organization] in that sense.” Luca Prosperi, CEO of M^ZERO Labs

Ultimately, whether the benefits of running a stealth mode starup outweigh the drawbacks depends on the specific circumstances and goals of each startup. It is essential for startups to carefully evaluate the potential trade-offs and decide whether the strategic advantages of operating in stealth mode align with their long-term objectives and growth strategy.

Hire better together

We work with Europe’s leading companies to hire key positions in Finance.